Winter 2025 Electricity Market Outlook

Welcome to our latest edition of Between the Lines, Tenco's publication, highlighting our capability, people, and ideas.

Winter 2025 Electricity Market Outlook

Tight Conditions Persist Amid Regulatory Shifts

As New Zealand heads into winter 2025, electricity market conditions remain tight due to low hydro storage, constrained gas supply, and infrastructure bottlenecks. Regulatory initiatives are underway to improve hedge market liquidity and strengthen retail competition, but volatility is expected to persist in the short term.

Hydro Storage and Gas Supply: A Recurring Concern

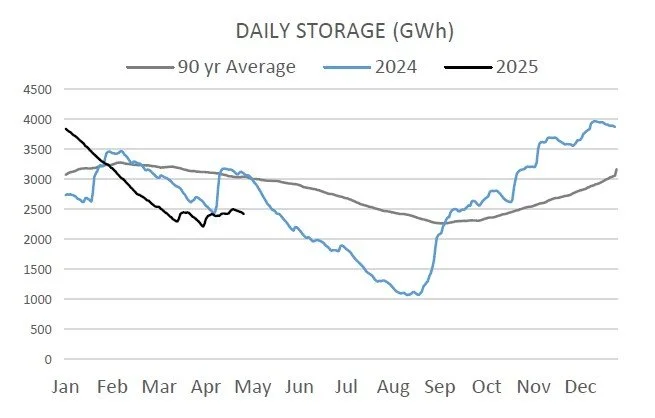

Since the start of 2025, hydro storage levels have declined more rapidly than in 2024, reaching historically low levels earlier in the year. This trend is attributed to below-average rainfall in key catchment areas. Short term electricity wholesale pricing has trended upwards in line with these declining storage levels with little respite in the long-term weather forecasts.

NZ Lake Levels/Storage. Source Metservice and NZX

Compounding the issue, gas supply forecasts have been downgraded due to lower production, leading to increased reliance on other forms of thermal generation. This shift has in turn elevated the Electricity Risk Curves for 2025 and 2026 – updated regularly by the Electricity Authority to assess supply security – signalling heightened risks of electricity shortages. Certain steps are being taken to mitigate a repeat of the winter 2024 market price spikes, including Genesis increasing their stockpile of coal to power the Huntly Power Station and Methanex, which uses approximately 45% of New Zealand’s gas output, will again divert its contracted gas volumes to support electricity generation.

Further, the flexibility built into the Tiwai Point Aluminium Smelter electricity agreement has already been called upon, allowing demand reductions to help manage system stress.

The importance of Huntly’s multi-fuel capability (coal, gas, and biomass) cannot be understated, with the station expected to play a critical role in system security through to at least the mid-2030s, bridging the gap while new renewable generation is built.

Tenco is aware commercial gas contracts are once again difficult to come by. Both retailers offering commercial gas supply are reluctant to offer long-term contracts until gas supply constraints are further understood.

Regulatory Initiatives: Striving for Market Equity

In response to ongoing market volatility and concerns about fairness, the Electricity Authority has proposed new rules requiring large generator-retailers to offer hedge products on non-discriminatory terms. If adopted, these changes could foster a more competitive retail market, potentially benefiting consumers over time -- as smaller, independent retailers would be better able to compete, innovate, and offer alternatives to the major players. Read more about the Energy Competition Task Force

Market Challenges: Investment Hesitancy and Supply Risks

The current tightness in electricity supply also reflects years of underinvestment in new generation. Policy decisions, such as the 2018 ban on new offshore oil and gas exploration, created uncertainty around future fuel availability. This has been compounded by faster-than-expected declines in production from existing gas fields, and prolonged uncertainty over the future of the Tiwai Point Aluminium Smelter — New Zealand’s largest single electricity user.

Taken together, these factors have made developers cautious about committing capital to large new generation projects, contributing to today's supply-demand tightness and amplifying market sensitivity to dry hydrological conditions and gas supply disruptions.

Generation Queue: Infrastructure Strains Amid Renewable Expansion

A major factor in how we view long-term electricity pricing is how quickly new generation can be built. The push towards renewable energy has led to a significant increase in proposed generation projects. Transpower generation connection project updates show both a healthy pipeline of new generation in delivery and investigation phases. However, the surge in applications has raised concerns about potential bottlenecks in transmission connections, which could delay the integration of new renewable generation into the grid.

Recent delays in consenting, such as those faced by Contact Energy for their proposed Southland wind farm, highlight growing risks for future renewable investment. A complex and lengthy consenting process may deter overseas investors from backing new large-scale renewable projects, at a time when New Zealand's decarbonisation goals require significant private capital.

Meanwhile, growth in the commercial solar sector is helping diversify supply, with businesses increasingly installing their own generation to offset rising electricity costs and contribute to system flexibility.

Outlook: Navigating a Challenging Winter

The convergence of low hydro storage, constrained gas supplies, and infrastructure challenges suggests that electricity prices will remain elevated through winter 2025. While regulatory efforts aim to enhance market fairness and stimulate generation investment, their impact may not be immediate. Clients should prepare for continued volatility and monitor developments closely as the season progresses.

Tenco operates an in-house tender desk that can source competitive electricity and gas supply contracts. If you have any energy supply agreements that will expire within the next six months, you should start thinking about contract renewals right away. Contact our tender desk to begin the process if you require support.

Stay Connected

To keep up with all our latest information and updates, please visit our website at tenco-ebs.co.nz. If you have any inquiries, don't hesitate to reach out to us directly at info@tenco-ebs.co.nz. Alternatively, you can contact us by phone at 0800 359 500.